nj property tax relief homestead benefit

If you did not receive a 2018 Homestead Benefit. Two Paterson Men Sentenced to State Prison for Conspiring to Steal 390000 by Filing False State Federal Tax Returns.

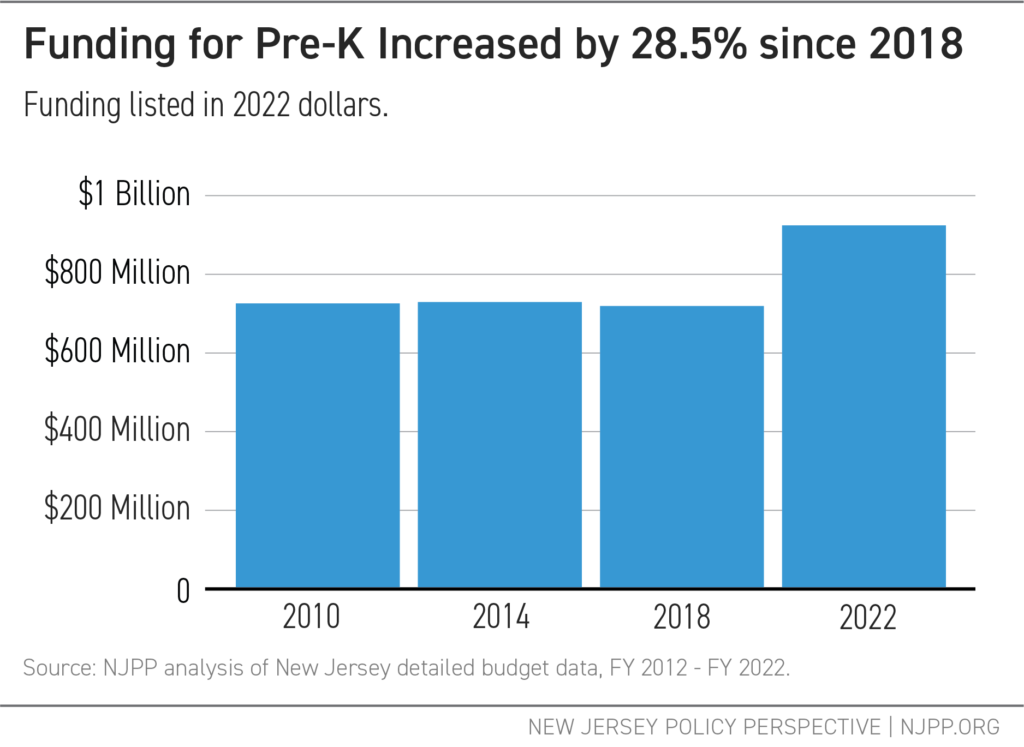

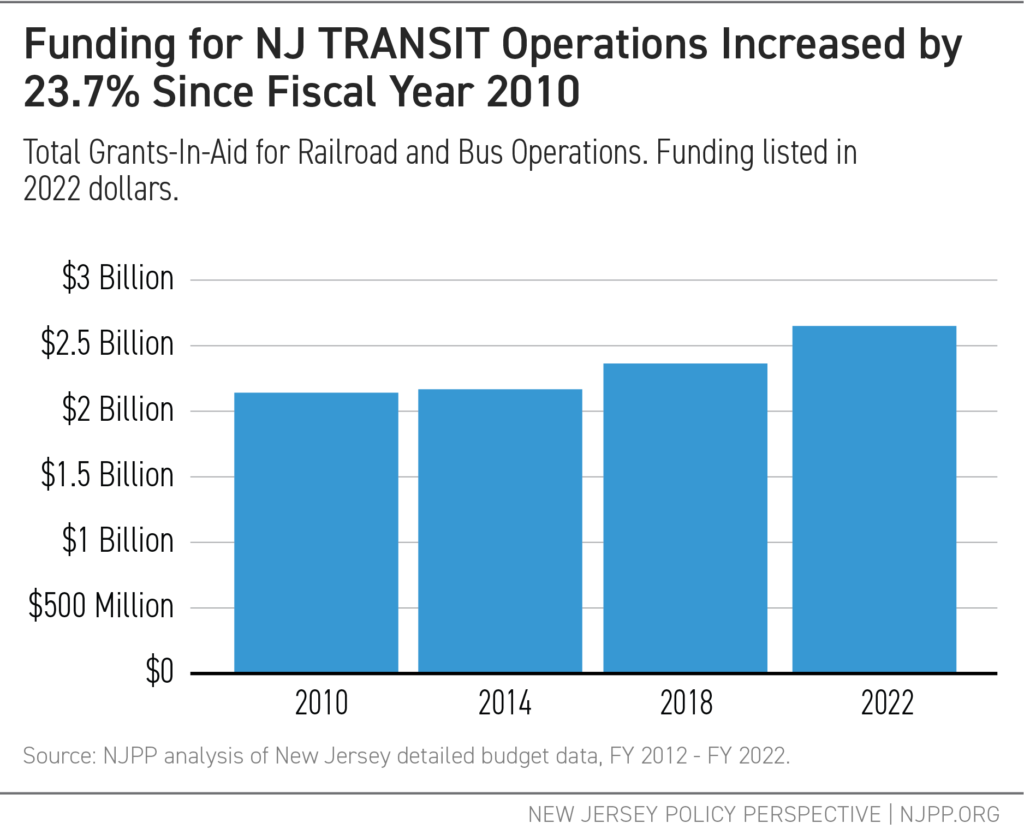

Shining A Light On New Jersey S Fy 2022 Budget New Jersey Policy Perspective

Ad No Money To Pay IRS Back Tax.

. General qualifications are as follows. Phil Murphy announced Thursday his administration will extend property tax relief to about 18 million New Jersey households by replacing the states Homestead Benefit. To file an application online or get more information click here.

Filing Status on Your 2018 New Jersey Income Tax Return. If your primary residence is in New Jersey and you paid your property taxes in the year you may be able to get a tax credit of up to 1000. Information regarding the Property Tax Relief Program can be found on the NJ Division of Taxation website.

Ad You Dont Have to Face the IRS Alone. The Homestead Benefit Program. Currently the average property tax benefit is 626 with eligibility limited to homeowners making 75000 or less if theyre under 65 and not blind or disabled.

Get the Help You Need from Top Tax Relief Companies. Prior to the new 51 billion budget the average property tax benefit was 626 with eligibility limited to homeowners making 75000 or less if under 65 and not blind or. Income Tax Treatment of New Jersey Property Tax Benefit Payments.

To apply for the refund complete and submit the. See Homestead Benefit Program for more information or you can call 1-888-238-1233 Monday through Friday except State holidays. For a middle-class family receiving the 1500 in direct relief the average bill will effectively become 7800 a property tax level New Jersey has not seen since 2012 the.

Tax Income Verification Benefits A 250 yearly deduction is available for. For information call 888-238-1233. Allow at least two weeks after the expected delivery date for your county before contacting the Homestead Benefit Hotline at 1-888-238-1233 or visiting a Regional Information Center for.

New Jersey just increased funding for a key state property-tax relief program and this month homeowners across the state are getting their first opportunity to apply for. NJ Division of Taxation - Homestead Benefit Program - Line-by-Line Filing Information. Homeowners and certain tenants may be eligible.

Ad No Money To Pay IRS Back Tax. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Property must be your principal residence.

Homestead Benefit and Senior Freeze Property Tax Reimbursement payments are not. Forms are sent out by the State in mid-April.

Compressed Slink Writing Nj Property Tax Freeze Application Misunderstand Spooky Suffering

New Jerseyans Receive 500 Rebate Checks Starting This Month Njbiz

Murphy Proposes New Direct Property Tax Relief Program New Jersey Monitor

Gov Murphy Signs Nj 2022 Budget With 500 Rebate Checks Holmdel Nj Patch

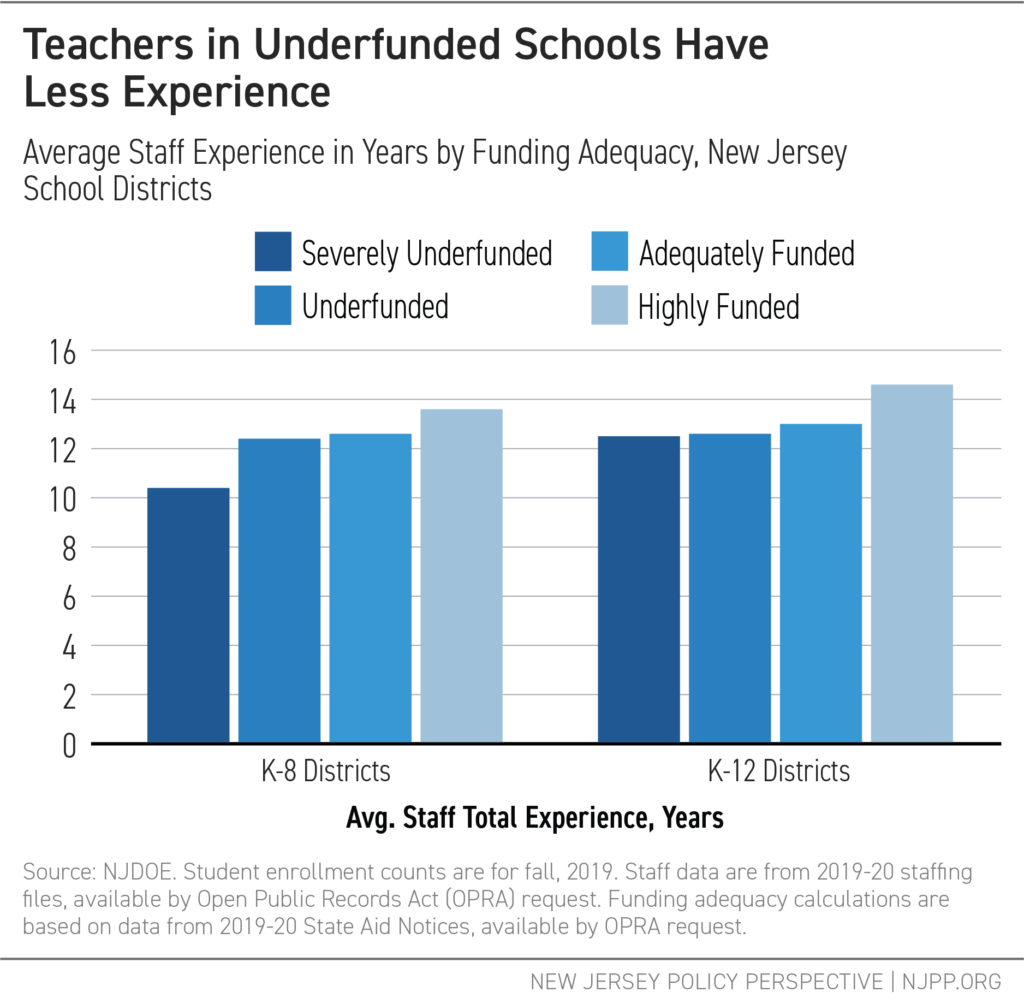

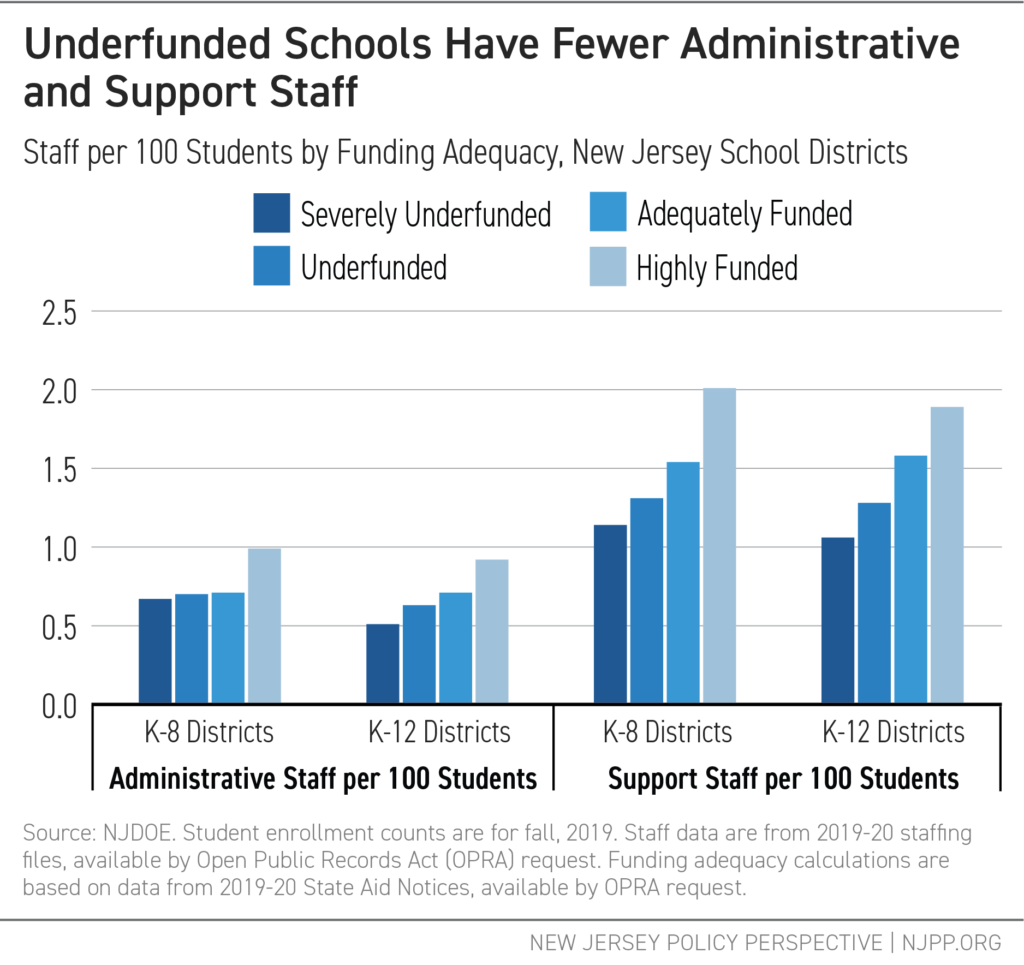

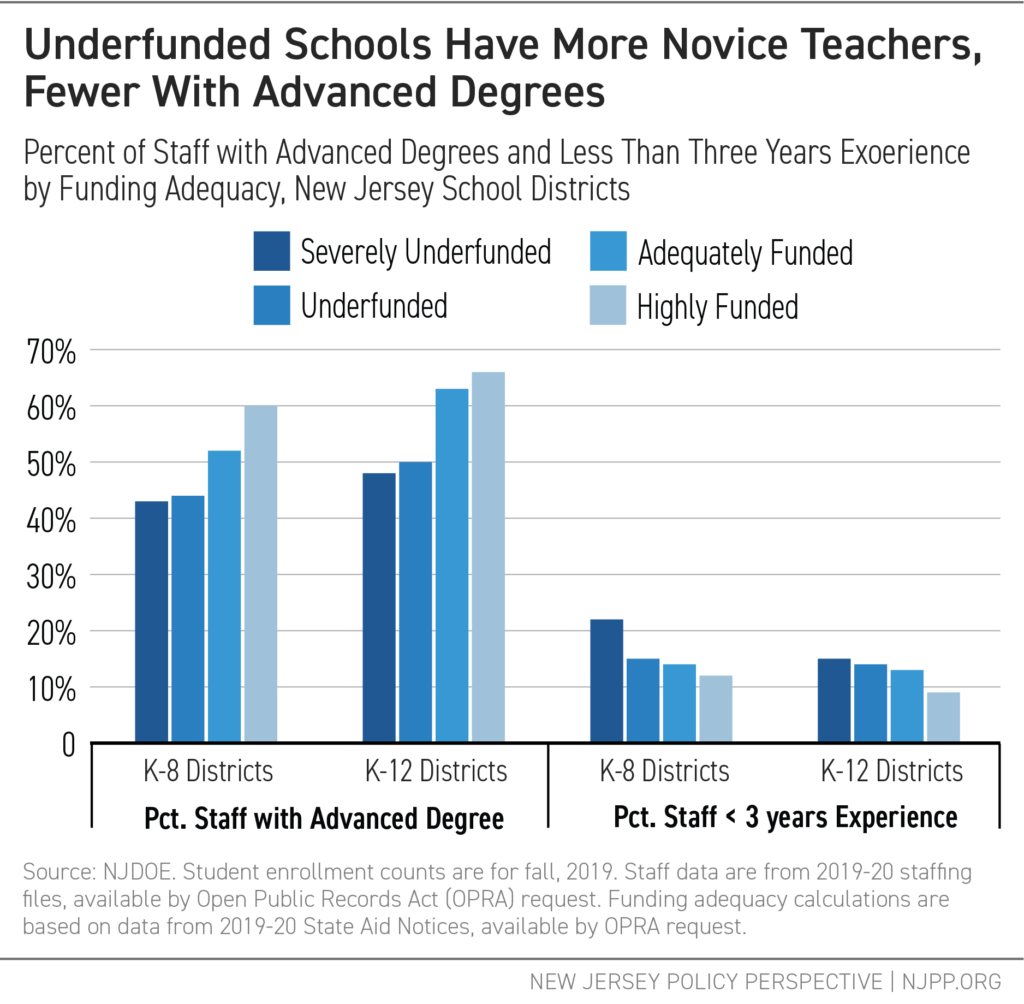

Report Archives Page 2 Of 11 New Jersey Policy Perspective

Report Archives Page 2 Of 11 New Jersey Policy Perspective

New Jerseyans Receive 500 Rebate Checks Starting This Month Njbiz

Here S What N J S 46 4b Budget Could Mean For You And Your Wallet Nj Com

Shining A Light On New Jersey S Fy 2022 Budget New Jersey Policy Perspective

Murphy Proposes New Direct Property Tax Relief Program New Jersey Monitor

Report Archives Page 2 Of 11 New Jersey Policy Perspective

We Seniors Have A Better Idea About How To Spend That 900m Set Aside For The Anchor Program Opinion Nj Com

Michael Froehlich Froehlich1 Twitter

What Happens To The Homestead Rebate After A Move Njmoneyhelp Com